News

News

TIPI Group of Companies

By Kendra Hinton

•

29 Nov, 2023

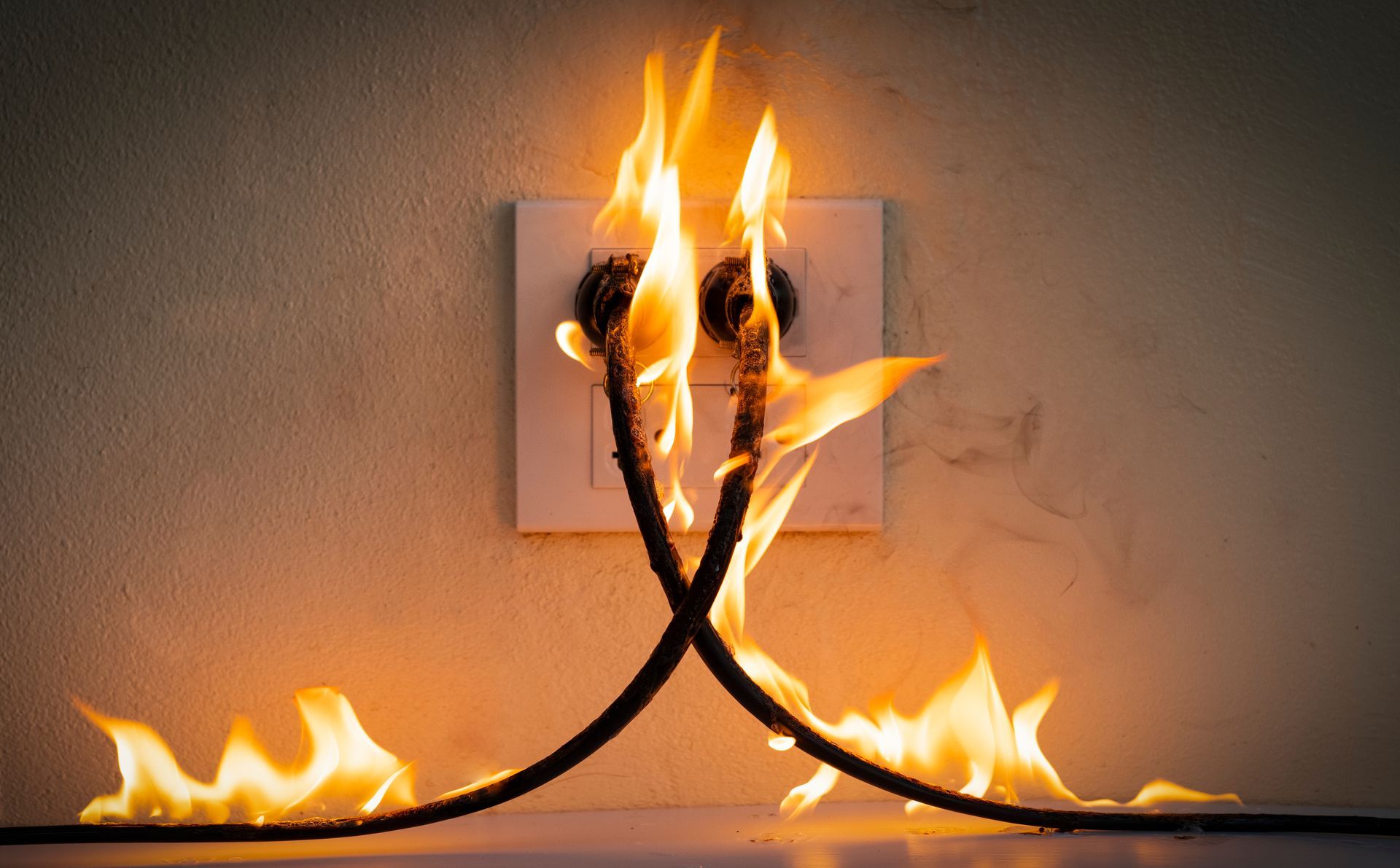

Learning how to prevent fires is one of the most important things you can do for your home and your community. Many homes and buildings are lost or damaged in communities due to negligence, which could be anything from being careless with discarding cigarette butts or not cleaning your dryer lint traps after each load. Read on for some fire safety tips to help you protect your home and communities from preventable fires. Extinguish and discard cigarettes properly. Make sure to completely extinguish before discarding. Cigarettes and other smoking materials that are not properly extinguished can still burn undetected and smoulder for days before starting a fire. The most common cause of fires from cigarettes have started from incorrectly extinguished smokes in planters around the house. Limit use of outlet extenders or plug-in power bars. Too many electronics plugged into to an outlet or power bar can quickly overload an electrical circuit. This can cause sparks, smoke, and lead to a fire that can do much damage to your home. Never plug in a space heater into a power bar or extension cord. Remove lint from your dryer filter after every use. A clogged filter and lint trap make your dryer less efficient, reduces the airflow needed to keep heat from building up in vents, and forces lint onto the heating coils. Store towels, rags, and containers of cooking oil well away from the stove, and always turn off the stove before you leave the room. Be sure to keep anything flammable away from the stove, especially if it is turned on. Never leave the room with the stove left on. Have your chimney cleaned at least twice a year if you have a fireplace or wood stove. Without regular cleaning, tar-like byproducts of burning wood—called creosote—can build up in the chimney. Creosote is highly flammable, so the more creosote build-up in your chimney, the higher risk there is for chimney fires. Reduce risks when burning candles. Never leave burning candles unattended. Always extinguish all candles before leaving the room or going to bed. Never burn candles on or near anything that can catch fire (e.g. curtains, bedding, clothing, etc.). Always keep candles out of reach of children and pets, and always somewhere they cannot be knocked over. Purchase a fire extinguisher for your home. You should have the right tools handy in the event of a small fire before it grows to something bigger and out of control. When purchasing, always check for certification marks (such as ULC), the size of the fire it is designed for, and ensure that you can comfortably hold and operate it. To use, remember the order of operations: P.A.S.S. P ull – the pin A im – at the base of the fire S queeze – the trigger S weep – back and forth at the base of the fire vigorously Reducing the risk of fire now can help prevent the loss of your home and/or belongings. It is so easy for a fire to catch when we are not paying attention, so be sure to stay vigilant and follow the safety tips above. Want to learn more about property insurance and how to reduce risk in your community? Visit our Property & Casualty page: https://www.tipionline.ca/property-and-casualty

21 Jun, 2023

By TIPI Staff Disability insurance helps protect your economic wellbeing. If you’re unable to work because of illness or an accident, this coverage can replace some of your earnings with a monthly benefit to help you pay your expenses. But how does it work exactly? Read on for some frequently asked questions our team receives from clients! Frequently asked questions What is the purpose of disability insurance? What does disability insurance cover? How do I apply for disability insurance? How do I submit my disability claim? How much do I receive from disability insurance? How long can I stay on disability insurance once I’m approved? My family member is sick, and I need to stay home to take care of them. Can I use disability insurance for this purpose? My spouse is on my plan and is unable to work, can they apply for disability under my plan? Why is my case manager asking for medical information? Do the short-term disability insurance premiums continue once an employee is approved for short-term disability? When completing forms what do I put as the last day worked and first day absent? Will I receive my benefits on the same pay schedule as my job? What is the difference between "own occupation" and "any occupation" in disability insurance? Answers to your questions about disability insurance What is the purpose of disability insurance? Disability insurance is a wage replacement benefit. Its purpose is to support employees if they are unable to work due to illness or accident while they recover with a goal of them returning to work. Disability insurance is not meant to be used as a lifetime support. What does disability insurance cover? There are many illnesses and injuries covered through disability, but it is important to determine whether the illness or injury prevents you from performing the duties of your job. In order for your coverages to be approved, you must meet the definition of disability as defined in your group policy. This information can be found in your benefit booklet, which can be obtained from your employer’s Plan Administrator, or by accessing the Plan Details section of the TIPI Care Plan Portal . How do I apply for disability insurance? If you are unable to work due to an illness or injury, you can start your disability claim by calling our office and speaking to one of our disability client service representatives. They will guide you through the process of applying for disability through your disability insurance provider. There are typically three forms that need to be submitted as part of your claim: an employer statement, an employee statement, and an attending physician’s statement. Some providers may require additional forms. How do I submit my disability claim? You can submit your claim through our office by emailing [email protected] or by faxing your claim to 204-949-3503. How much do I receive from disability insurance? The amount of income replacement you would receive depends on your group benefit plan and your regular salary. It is a specific percentage of your pre-disability earnings determined according to your group benefit plan. This information can be found in your benefit booklet, which can be obtained from your employer’s Plan Administrator, or by accessing the Plan Details section of the TIPI Care Plan Portal . How long can I stay on disability insurance once I’m approved? Once approved for disability, you will continue to receive benefits provided you continue to meet the definition of disability. This is determined by your condition, severity of symptoms, and the provisions of your group benefits plan. Short-term disability and long-term disability both have a maximum length of time you can receive benefits. This varies from plan to plan, and this can be found in your benefit booklet, which can be obtained from your employer’s Plan Administrator, or by accessing the Plan Details section of the TIPI Care Plan Portal . My family member is sick, and I need to stay home to take care of them. Can I use disability insurance for this purpose? No, disability insurance can only be used when the employee is sick or injured. Compassionate care may be an option and is available through the federal Employment Insurance program. My spouse is on my plan and is unable to work. Are they able to apply for disability under my plan? No, the disability insurance provided under the group plan only applies to the employee. Why is my case manager asking for medical information? After your claim has been approved, a case manager will be assigned to you. As you go through your recovery process, they may request additional medical information to assess your progress, determine whether you continue to meet the definition of disability, and determine whether additional supports can be provided. Do the short-term disability insurance premiums continue once I am approved for short-term disability? Yes, the premiums for short-term disability are charged throughout the short-term disability period. Once the employee is approved for long-term disability, the premiums for short-term disability are waived. When completing forms what should I put as the last day worked and first day absent? Your last day worked is the day that the employee was last performing the duties of their job. Your first day absent is the first day they were scheduled to work but were unable to work because they had become disabled. If your employer paid you sick or vacation time after you were last at work, there is also a place to enter this date. Will I receive my benefits on the same pay schedule as my job? Your payment schedule is determined by the date you became disabled and your waiting period according to your plan. What is the difference between "own occupation" and "any occupation" for long-term disability insurance? On most benefit plans, for the first two years of disability, you are insured based on the " own occupation " definition, which means your specific job duties that you had been performing up to the time you became disabled . After two years , pending medical evidence, the insurance provider will assess if your disability prevents you from being gainfully employed in any job which provides you with an income of at least 50% of your monthly earnings before you became disabled. Your disability claim may be extended if you cannot do any job as noted above within a pre-determined distance from your home city, as determined by your benefit plan and/or provincial legislation. Don’t see your question here? Reach out to our team by email at [email protected] , or by phone at 1-855-266-TIPI (8474).

By Mallory Clarkson

•

13 Feb, 2023

There are many reasons why you might need to make a Property & Casualty insurance claim. A fire or flood could damage your property; your business could be burglarized or frauded; one of your staff members could get into a collision while using a company vehicle. Here are the steps you should take if you need to make a Property & Casualty insurance claim: Prevent further damage If needed, call emergency services for emergent situations. If required, call emergency restoration services to prevent the situation from worsening. For example, you would call emergency restoration services to pump out water and dry a building out in the event of a flood to prevent the development of mold. File a report with the authorities In some incidents, we will require an official report from the authorities to be able to process your claim. For example, in the case of a fire, we will need a report from the Fire Marshal and in the case of a crime like fraud or burglary, we will require a police report. Call your account executive As soon as possible, notify your insurance broker of the incident. Provide as much detail as possible about the circumstances and the assets that have been damaged or lost. If it is safe to do so, take photos of the damage. Be sure to provide a main point of contact for the individual who will be handling the claim. Await an adjuster After you make a claim, you will be contacted by an adjuster who will set up a time to take a statement, will determine the amount of damage or loss, and will go over a proof of loss. The adjuster will hire an appraiser or contractor to assess the loss. Get quotes Get quotes (usually three) for repairs or replacements. Submit them before beginning repairs or replacing assets. Once completed, the adjuster will contact you regarding the settlement of your claim and payment. Be sure to spend time familiarizing yourself with your policy to ensure you understand your coverages, rights, and responsibilities. Contact your account executive to review your policy to ensure all coverages of properties, assets, and operations are up-to-date.

09 Nov, 2022

By Geoff Kirbyson for Manitoba Inc. Magazine Nathan Ballantyne would like to challenge Indigenous leaders across the country to reverse economic leakage from their communities. The CEO of the TIPI Group of Companies , a Winnipeg-based conglomerate with subsidiaries in insurance, human resource management and reconciliation training, says his challenge represents a more than billion-dollar opportunity. Economic leakage occurs when money earned inside a community or jurisdiction flows to outside service providers. It’s impossible to calculate the extent of leakage from all First Nations across the country but Ballantyne says in the insurance industry alone, “millions and millions” of dollars in fees and commissions are paid out to non-Indigenous providers. “Indigenous communities suffer the worst economic leakage in the country. We’re making a small dent in that to change the story, but we have a long way to go,” he says. Ballantyne believes the average Canadian thinks First Nations receive billions of dollars in federal funding, but they can’t understand why their communities aren’t more prosperous. While there’s no denying the initial capital flows, he says money in First Nations doesn’t circulate in the same way as it does elsewhere in Canada. In non-First Nations communities, money changing hands between consumers, businesses and service providers circulates three to five times before it goes elsewhere, he says. “Typically, a dollar comes in (to First Nations) and 90 cents flows directly to outside businesses, including consultants and lawyers. It doesn’t circulate. There isn’t the same infrastructure. If the average Canadian community sees a dollar circulate two to three times, it’s a fraction of that in Indigenous communities,” he says. “The way to change that is have those dollars change hands more times within the community. That’s a guiding principle of why our company exists.” Indeed, preventing economic leakage is one of TIPI’s primary focuses and permeates virtually everything the company does through its value chain. “When we do business with suppliers, we look at who we’re using to buy our jackets and our swag. We want to use Indigenous companies and people. That’s the core of who we are,” he says. On the company’s group insurance and group pension business, TIPI has moved further up its value chain. In the traditional model, a broker would ask large insurance providers for quotes. TIPI has taken steps to become its own middleman, collecting premiums and paying insurers. “That gives us more power and control to be able to challenge the status quo,” he says. One problem that Ballantyne sees in the Indigenous economy is the notion that each business should be community owned. That’s not how things work in the greater Canadian economy, where most successful businesses were started by entrepreneurs. He believes the Indigenous economy should be a mix of both. Employees at community-owned enterprises don’t have the same incentives to provide exemplary services as their entrepreneurial brethren, he says. “If the City of Winnipeg owned a gas station, would employees care if the pumps were full and could gas up their customers? It’s different when you’re an entrepreneur. You’d say, ‘I’m going to make damn sure there’s gas and we ensure every customer’s windows are clean. We haven’t got that right yet,” he says. TIPI is constantly on the lookout to do things differently than they’ve been done traditionally and that’s contributing to less leakage. “We’re insuring communities’ land claims with the federal government. If they’ve got an unsettled land claim, it’s expensive to hire researchers and lawyers to fight the government. We’ve built a new insurance model that will insure those costs and give the community access to a line of credit and access to capital. That’s all instead of paying a non-Indigenous law firm millions of dollars,” he says. Perhaps the quickest way Indigenous businesses can start to reduce economic leakage is simply to be aware of their landlord. Ballantyne says TIPI does its best to ensure its subsidiaries hang up their shingle in urban reserves. For example, its head office is located in the Indigenous-owned Peguis Business Centre on Portage Avenue. TIPI’s shareholders ensure that its millions of dollars in profits stay in its communities for as long as possible. “The story is changing. Ten or 15 years ago, it was tough to find an Indigenous marketing firm or an Indigenous law firm. Today, there are a ton of bright, educated Indigenous people across the country who are waiting to be engaged to build their businesses and be successful,” he says.

08 Aug, 2022

By Stephanie Cyca for Industry West Magazine The industries of banking and insurance have a longstanding, western ideology-based tradition. When you think of banking, insurance, and financial institutions there is likely a set image in your mind as to what banking and insurance are and are not. But as Canada and society move forward there are more and more challenges to traditional approaches to long set industry standards. The First Nations Bank of Canada (FNBC) and TIPI-IMI Insurance Partners are two companies that have established themselves as Indigenous banking and finance institutions that serve their communities and bring about the unique perspectives and understanding that are missing from the world of finance. FNBC began its journey in the Canadian financial landscape in 1996. There were two main driving forces that led to the bank’s opening, first, the need for a bank to serve Indigenous clients, especially as the Indigenous communities started to experience their own economic growth. The second factor was identifying that while these communities were starting to experience growth, there were also issues that they were facing—issues that were not being addressed by the traditional banking and finance worlds. The founders of FNBC had a vision to develop a federally-chartered bank serving Indigenous and non-Indigenous people throughout Canada. The bank was conceived and developed by Indigenous People, for Indigenous People as an important step toward Indigenous economic self-sufficiency. “In 1996, we founded First Nations Bank of Canada to bring both financial and social returns to Indigenous People and communities who were under-served by existing financial services options,” explains Keith Martell, president and CEO, First Nations Bank of Canada and FNB Trust . The challenges that Indigenous people face are sometimes obvious, such as the Indian Act setting out that reserve land is owned by the Crown, which prevents banks and lending institutions from recognizing it as security. Other barriers do not relate to laws or legalities, but to physical locations, distance, and diversity. Remote northern locations are tricky to access, sometimes costing plane rides of $800 or more, and mainstream financial institutions either cannot, or do not want to, deal with accommodations. Finally, until more recently, there hasn’t been a lot of diversity and inclusion in the banking and insurance sectors. Today, most of the customers of the FNBC are Indigenous, 60 to 75 per cent of staff, and 89 per cent of shareholders are also Indigenous Peoples. “[We strive to provide a place that] makes people comfortable to do banking there,” explains Martell. And it’s not just the customers that they want to feel comfortable. This past March, FNBC was once again named one of Saskatchewan’s Top Employers by Mediacorp Canada Inc. for providing its employees with an exceptional place to work. Operating to bridge the gap between traditional financial institutions and Indigenous culture is the basis, and one of the founding principles, of TIPI-IMI Insurance Partners . TIPI-IMI have been working towards not only creating accessible and flexible insurance coverage for their clients and customers, but working to become a part of these communities and understand the root causes of issues. By conducting business with a degree of care and understanding, they can not only shape policies that help their customers, but they have become a positive force in the communities they serve. TIPI-IMI does not only offer insurance packages to their clients, they work to understand the communities individually and intimately, constantly striving to determine where they can be of the most assistance. This might be working to start programs to help identify and report areas in a community that lack proper fire protection, working to help alleviate housing shortages, or being a third-party go-between for communities and the government for things like grants and funding. Nathan Ballantyne, CEO of TIPI-IMI, said, “[TIPI-IMI] wants to offer our services as a total community coverage and wrap our arms around our clients.” One of the biggest issues that Ballantyne identified and worked towards combating early on with TIPI-IMI was the concept of “economic leakage”. This is where a community has money or funding but must turn outside of the community for goods and services, thus leading to leakage from the local economy. If the community can put the funds back into circulation, growth will follow. It was difficult work, Ballantyne noted, but he is grateful for those who walked with them, had the hard conversations, and worked to stop the economic leakage. And while TIPI-IMI had entered the financial field on the defensive, with all the work that has been done the tides are now beginning to turn. “As an Indigenous company, it honestly feels that we have to work harder than a non-Indigenous company due to preconceptions and stigma,” said Ballantyne. He noted that there is a pressure to feel the need to prove themselves more than others, but that this pressure has also lit the fire that has driven TIPI-IMI to be as successful as they are today. Janice Gladue, COO of TIPI-IMI , also spoke about the future of what can be done to help bring about better services and inclusion to Indigenous people. There is a lot of talk about Indigenizing the industry as of late, but Gladue questions this. “Is this possible, or even the goal?” she asks. “The better question is: how do we influence?” Gladue posits. “Our goal should be using our values, not only as a company but as Indigenous individuals – protecting, being there for others in the community.” Fundamentally the way business is conducted around the world is changing and moving forward in big ways. The global and Canadian economies are seeing driving changes. While there is much work still to be done, groups like First Nations Bank and TIPI-IMI are finding that they now have a place at the table. By being able to use their voices and raise concerns, there is now the potential help to shape the future of finance.

Site Map

Contact Us

National Head Office

Suite 100 – 1075 Portage Avenue

Winnipeg, Manitoba, R3G 0R8

Saskatoon Office

160-217 Joseph Okemasis Drive

Saskatoon, Saskatchewan, S7N 3A8

The Pas Office

314 Edwards Avenue

The Pas, Manitoba, R9A 1K6

National Head Office

Toll-free

Email us at

Join our newsletter

Newsletter Registration

Thank you for registering for our newsletter.

Oops, there was an error registering for our newsletter. Please try again later.

© 2024

TIPI Insurance Partners | All Rights Reserved | Created by CCC