TIPI Group of Companies is Reconciliation in Action

By Industry West Staff

Canada is in the midst of a critical chapter in its history. The country is coming to terms with how it came to be what it is today and who was tragically and brutally impacted by the creation of the nation we call home. As we collectively acknowledge and address what can be done to rectify the past and move forward together, there is a company that has always embraced its inherent Indigeneity while serving its clients and living its Indigenous values every day.

Humble beginnings

Today known as the TIPI Group of Companies, the venture got its start in 1999 as an insurance brokerage working with traditionally underserved First Nations in Manitoba. “We identified that Indigenous communities were often underrepresented, oversold or had poor access to insurance,” says Janice Gladue, COO at TIPI Group of Companies. “The work began with Swampy Cree Tribal Council as a partner to start to build meaningful relationships with Indigenous communities and provide stronger access to insurance markets and coverages. Building capacity in the sector and creating wealth for First Nations were also key goals.” Little did they know that the idea would be revolutionary.

Fixing the gaps

TIPI and TIPI-IMI Insurance Partners worked to address the gaps in the insurance market to serve Canada’s Indigenous communities and peoples by embracing their culture. The company’s products and services are developed for and by the people who want them—whether you need a conventional policy or not, they can help.

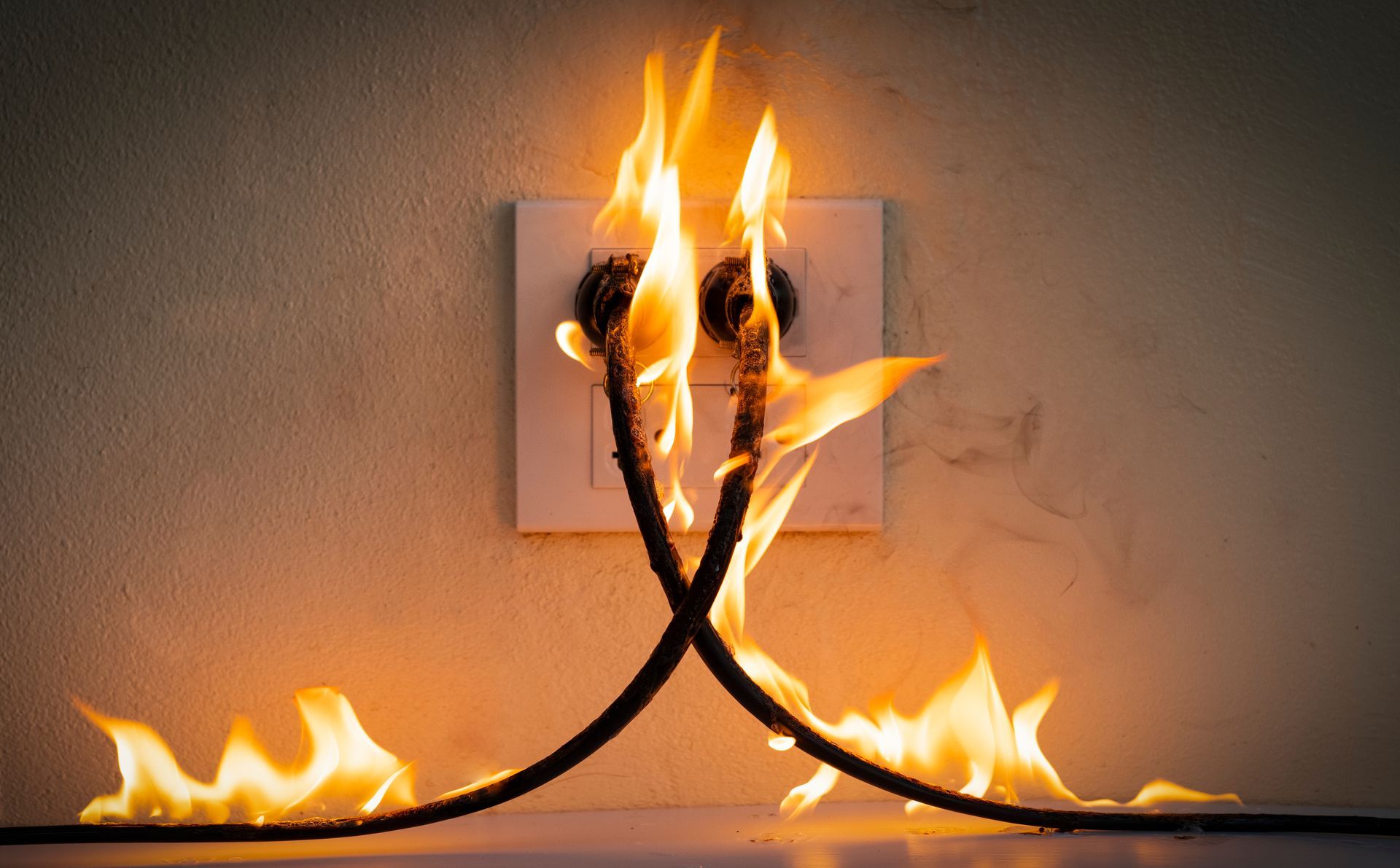

“Traditional insurance coverage did not address the needs of Indigenous people,” says Gladue. “We sought the changes needed to make it work.” For example, typical insurance coverage requires that a property be rebuilt in the same location within one year of a loss such as fire or flood. In Indigenous communities, that is unrealistic for both cultural and logistical reasons. Indigenous culture does not look favourably on rebuilding on the exact spot of a loss, and often, materials and labour needed to rebuild take longer to arrive in communities. “We worked with industry partners to have these changes made to policies to allow for this,” says Gladue. “Some simple modifications made insurance coverage possible.”

The company also built capacity in the insurance sector for Indigenous insurance professionals to start and build careers in the industry. “Having professionals who are Indigenous providing services to Indigenous communities and families is also huge part of what we do as a company,” says Gladue. “Plus, our success always goes back to our community owners. We’re majority Indigenous-owned, and our profits go back to the people we serve to create even more success.”

Standing tall

TIPI has evolved over the last 20 years into the TIPI Group of Companies it is today. Part of the TIPI Group of Companies, TIPI Insurance Partners and TIPI-IMI Insurance Partners are the only Indigenous full-line insurance operations offering group pension, group benefits and property and casualty insurance in Canada. “We owe a lot to our original experienced, industry partners who shared their capacity to get us off the ground and sacrificed a lot to help us get going,” says Gladue. “Plus, our Indigenous partners kept their doors open to us and were always willing to have tough conversations.” TIPI Group also acquired Legacy Bowes, the well-known Manitoba-based human resources and recruitment firm in recent years—its latest move to build capacity while holding strong to its foundations as an Indigenous business leader.

Knowing what matters

Through all its growth, the company has held strong to its core values of trust, compassion, friendship, social responsibility and professionalism. “It’s hard to describe how we live our values because it’s just part of who we are. It’s in our DNA,” says Gladue. “I think of all of them, friendship is the one that makes us stand out. It’s part and parcel of our Indigenous roots.” TIPI’s commitment to friendship is more than building a relationship with a client. It’s about being there through the peaks and the valleys, and knowing that no matter what, you’re there for each other. “Friendship is when you’re there for the most difficult times, and in insurance, that’s when you’ll likely be dealing with us,” she says. “It’s just the way we do business.”

“We’re proud of our story so far, and I believe our clients are too,” says Gladue. “Everyone is welcome to engage and do business with us and to play a part in the next phase of the TIPI Group of Companies story. We’re built to serve and work with everyone.”